When planning for long-term financial growth, it’s crucial to understand the differences between Fixed Deposits (FD) and Systematic Investment Plans (SIP) in mutual funds. Both have their own advantages and disadvantages, making them suitable for different types of investors and financial goals. Let’s explore each option in detail with simple explanations and examples in Indian Rupees (INR).

Suggested Read: 10 Smart Financial Tips to Increase Your Savings

FD vs SIP in Mutual Funds

Fixed Deposits (FD)

Advantages or Pros:

- Safety and Security: FDs are one of the safest investment options. Your money is protected, and you earn a guaranteed interest.

- Fixed Returns: The interest rate is fixed when you invest, so you know exactly how much you will earn.

- Liquidity: You can withdraw your money before the maturity date if needed, though there might be a penalty.

- Insurance: In India, bank deposits, including FDs, are insured up to ₹5,00,000 by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

In many countries, FDs are insured by the government up to a certain limit, adding extra security.

Disadvantages or Cons:

- Lower Returns: FDs usually offer lower returns compared to investments linked to the stock market.

- Taxation: Interest earned on FDs is fully taxable, reducing your actual earnings.

- Lack of Growth Potential: FDs do not benefit from the growth of the stock market, limiting their ability to generate substantial wealth.

Also Read: Should You Buy or Rent a Home in today’s market?

Systematic Investment Plans (SIP) in Mutual Funds

Advantages or Pros:

- Potential for Higher Returns: SIPs in mutual funds can provide higher returns as they are linked to the stock market.

- Rupee Cost Averaging: SIPs allow you to invest a fixed amount regularly, which helps average out the cost of your investments.

- Flexibility: You can start with a small amount and increase your investment over time. You can also pause or stop the SIP if needed. For Example: You might start with ₹1,000 per month and gradually increase to ₹5,000 per month as your income grows.

- Tax Efficiency: Long-term capital gains from equity mutual funds held for over a year are taxed at 12.5% as per new Tax rate change in 23 July 2024, if the gains exceed ₹1.25 lakh in a financial year.

Disadvantages or Cons:

- Market Risk: The value of your investment can go up or down based on the stock market’s performance. If the market crashes, the value of your mutual fund investment can decrease, resulting in temporary losses.

- Complexity: Choosing the right mutual fund requires some research and understanding of the market. You need to consider factors like fund performance, the expertise of the fund manager, and fees.

- Costs: Mutual funds charge management fees and other expenses, which can reduce your overall returns. For Example: A fund with a 2% annual fee reduces your effective return by that amount each year.

FD vs SIP in Mutual Funds: Comparing for 20 Years with Monthly Investments

To make a fair comparison, let’s consider investing ₹5,000 per month in both Fixed Deposits (FD) and Systematic Investment Plans (SIP) in mutual funds over 20 years. This will help us see the difference in growth between these two options over the same period and with the same investment amount.

Fixed Deposits (FD)

Let’s calculate the future value of investing ₹12,00,000 in an FD at an annual interest rate of 6.5%, compounded annually. The total principal amount invested over 20 years will be: Principal=₹12,00,000

We will use the future value formula for compounding:

A= P + P {(1 + r/100) n – 1}

Where:

- P=₹12,00,000 (Principal Investment Amount)

- r=6.5 (interest rate per year)

- n=20 (tenure in years)

To get the accurate value, we will compute it step-by-step:

For FD, the future value of Principal Investment Amount compounded annually needs to be calculated as a sum of compound interests of each year.

- Investment Amount: ₹12,00,000

- Annual Interest Rate: 6.5%

- Est. Return: ₹31,57,385

Future Value of FD: ≈₹43,57,385

Systematic Investment Plans (SIP) in Mutual Funds

Now let’s calculate the future value of investing ₹5,000 per month in an SIP assuming an average annual return of 12%.

Note: I am dividing the FD Principal Amount ₹12,00,000 into ₹5,000 per month for SIP

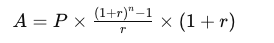

We will use the SIP future value formula:

Where:

- P=₹5,000 (monthly investment)

- r=0.12/12 (monthly return rate)

- n=12×20 (total number of months)

Systematic Investment Plan (SIP) Calculation:

For SIP, we will use the SIP future value formula.

- Investment Amount: ₹5,000 per month

- Total Principal Invested: ₹12,00,000 (₹5,000 x 12 months x 20 years)

- Average Annual Return Rate: 12% (compounded monthly)

Est. Return: ₹37,95,740

Future Value of SIP: ≈₹49,95,740

Summary of Results

Fixed Deposit (FD):

- Total Investment: ₹12,00,000 (One-time)

- Total Interest Earned: ₹31,57,385

- Future Value: ₹43,57,385

Systematic Investment Plan (SIP):

- Total Investment: ₹12,00,000 (₹5000 per month)

- Total Interest Earned: ₹37,95,740

- Future Value: ₹49,95,740

Conclusion

Investing ₹5,000 per month over 20 years yields significantly higher returns in a Systematic Investment Plan (SIP) compared to a Fixed Deposit (FD):

- FDs provide safety and guaranteed returns, making them suitable for conservative investors prioritizing capital protection.

- SIPs offer potential for much higher returns due to market-linked growth, ideal for investors willing to take on some risk for long-term wealth creation.

This comparison highlights the significant difference in growth potential between FDs and SIPs, making SIPs a more attractive option for long-term financial growth

Also Read: Should You Buy a Car or Rent? Which is Better for Saving Money and Financial Growth

FAQs

A Fixed Deposit (FD) is a financial instrument offered by banks and financial institutions where you deposit a lump sum amount for a fixed tenure at a predetermined interest rate. The principal and interest are paid out at maturity.

A Systematic Investment Plan (SIP) is an investment strategy offered by mutual funds where you invest a fixed amount regularly (monthly or quarterly) into a mutual fund scheme. It allows for disciplined investing and benefits from rupee cost averaging.

SIPs generally offer better long-term growth potential compared to FDs because they invest in equities or equity-oriented mutual funds, which can grow significantly over time. FDs offer safety and fixed returns but may not keep pace with inflation over the long term.

Yes, FD returns are taxable as per your income tax slab. However, you can claim tax benefits on FDs under Section 80C for certain types of FDs.

SIP investments are subject to tax based on the type of mutual fund. Equity mutual funds are subject to Long-Term Capital Gains (LTCG) tax if held for more than a year, with a current exemption up to ₹1 lakh per year. Debt mutual funds are taxed differently, with gains classified as Short-Term or Long-Term Capital Gains.

SIPs in mutual funds involve market risks and are subject to fluctuations in the stock market. While they have the potential for higher returns, they also come with higher volatility. FDs are low-risk and provide guaranteed returns, making them a safer option.

You can withdraw FDs prematurely, but you may face penalties or reduced interest rates. You can redeem SIPs at any time, but the value may vary based on market conditions.

SIPs generally offer better liquidity because you can redeem your investments in mutual funds at any time.

[…] Also Read: FD vs SIP in Mutual Funds: Which is Better for Long-Term Financial Growth? […]